The smart Trick of Paul B Insurance Medicare Advantage Plans Huntington That Nobody is Talking About

Wiki Article

The Single Strategy To Use For Paul B Insurance Medicare Advantage Plans Huntington

Table of ContentsSome Of Paul B Insurance Medicare Advantage Agent HuntingtonExamine This Report on Paul B Insurance Medicare Supplement Agent HuntingtonThe Only Guide for Paul B Insurance Medicare Agent HuntingtonThings about Paul B Insurance Medicare Supplement Agent HuntingtonFacts About Paul B Insurance Medicare Supplement Agent Huntington Revealed

(Individuals with particular specials needs or wellness problems might be qualified prior to they turn 65.) It's developed to safeguard the health and wellness and also wellness of those that utilize it. The 4 components of Medicare With Medicare, it is very important to comprehend Components A, B, C, and also D each component covers certain services, from healthcare to prescription medications.

If you're currently getting Social Safety and security advantages, you'll instantly be signed up partly An as soon as you're qualified. Discover about when to sign up in Medicare. You can get Component A at no charge if you or your partner paid into Medicare for at least ten years (or 40 quarters).

The smart Trick of Paul B Insurance Medicare Agent Huntington That Nobody is Discussing

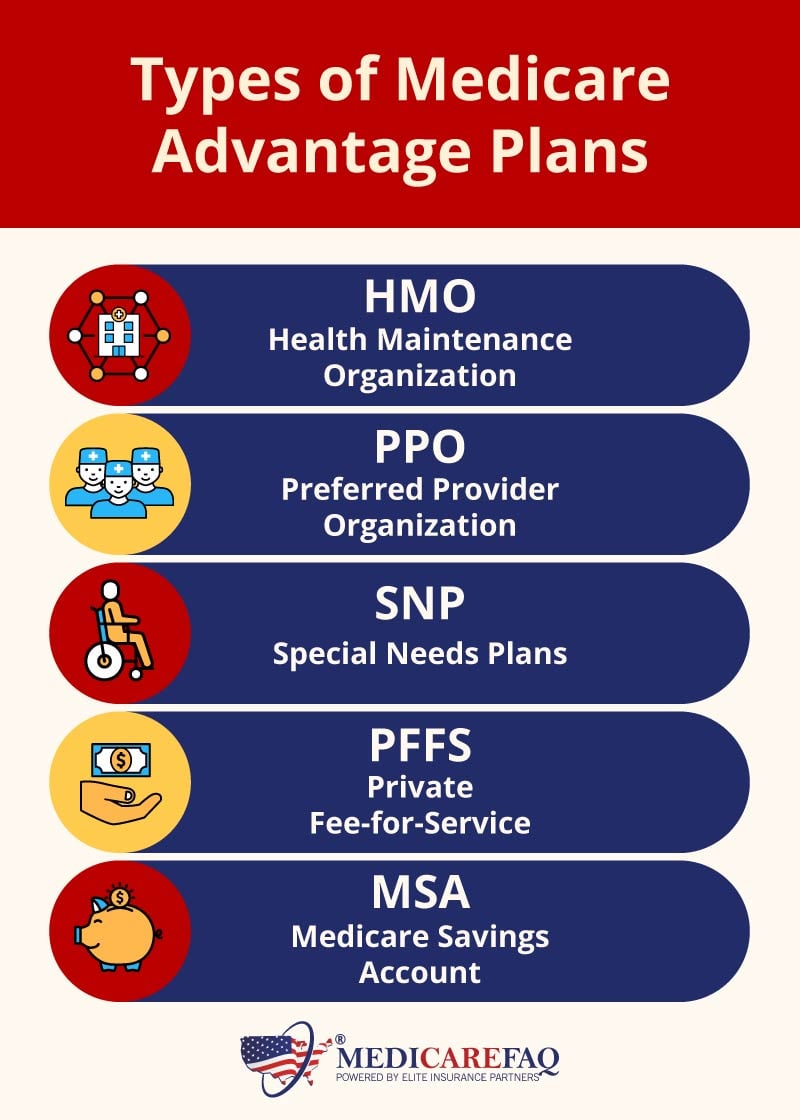

Medicare Advantage is an all-in-one plan that bundles Initial Medicare (Component An and also Part B) with added benefits. Kaiser Permanente Medicare health insurance are examples of Medicare Benefit strategies. Remember that you require to be registered partly B and also eligible for Component A before you can enroll in a Medicare Advantage plan.

Prior to we speak about what to ask, allow's discuss who to ask. There are a great deal of ways to authorize up for Medicare or to get the details you require prior to selecting a plan. For numerous, their Medicare trip starts straight with , the official website run by The Centers for Medicare and also Medicaid Solutions.

Not known Details About Paul B Insurance Local Medicare Agent Huntington

It covers Component A (hospital insurance policy) and Component B (medical insurance). These strategies function as an alternative to Initial Medicare, combining the protection alternatives of Parts An and B, as well as added benefits such as oral, vision and prescription medicine coverage (Component D).Medicare Supplement strategies are a great enhancement for those with Original Medicare, helping you cover expenses like deductibles, coinsurance get redirected here and also copays. After getting care, a Medicare Supplement strategy will certainly pay its share of what Original Medicare didn't cover after that you'll be in charge of whatever remains. Medicare Supplement prepares usually don't consist of prescription drug coverage.

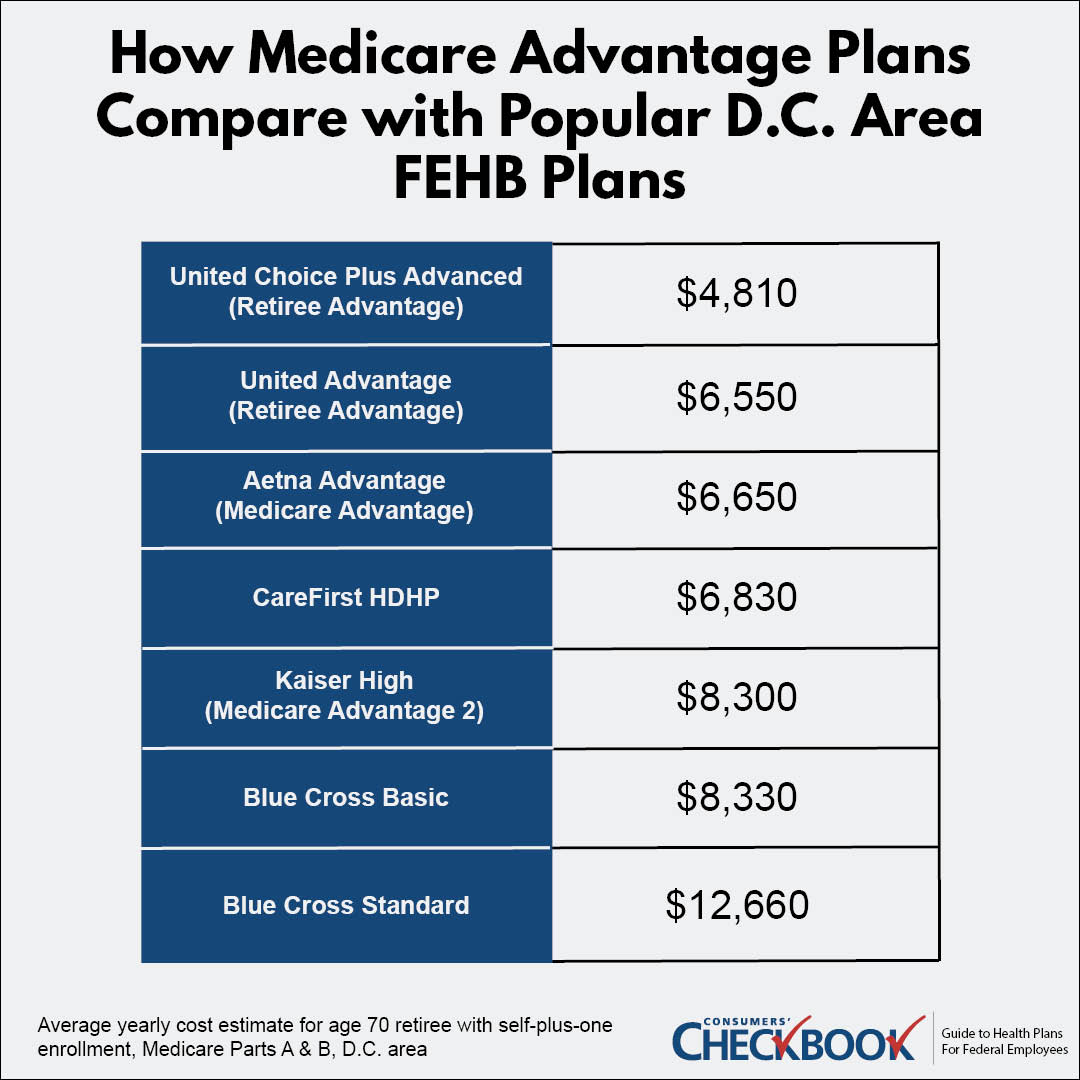

You can enlist in a separate Component D plan to include medication protection to Original Medicare, a Medicare Cost plan or a couple of other kinds of plans. For numerous, this is typically the very first question thought about when looking for a Medicare plan. The price of Medicare differs depending on your health care requirements, economic support eligibility and also exactly how you choose to get your benefits.

Things about Paul B Insurance Medicare Advantage Plans Huntington

For others like seeing the physician for a sticking around sinus infection or loading a prescription for covered anti-biotics you'll pay a cost. The amount you pay will be different depending upon the sort of strategy you have and whether or not you've taken treatment of your deductible. Medicine is an important part of care for numerous individuals, especially those over the age of 65.as well as seeing a provider who accepts Medicare. However what regarding taking a trip abroad? Many Medicare Advantage plans give global coverage, as well as coverage while you're traveling locally. If you intend on taking a trip, see to it to ask your Medicare advisor about what is and isn't covered. Perhaps you've been with your current doctor for a while, and also you desire to maintain seeing them.

Lots of people who make the switch to Medicare proceed seeing their routine doctor, but also for some, it's not that basic. If you're collaborating with a Medicare advisor, you can inquire if your medical professional will be in connect with your new plan. If you're looking at plans independently, you might have to click some links and also make some phone calls.

Paul B Insurance Insurance Agent For Medicare Huntington Things To Know Before You Get This

gov site to seek out your existing doctor or one more service provider, center or medical facility you intend to aig car insurance use. For Medicare Advantage best site plans and also Price plans, you can call the insurance policy company to see to it the doctors you desire to see are covered by the strategy you want. You can additionally inspect the strategy's website to see if they have an online search tool to find a protected medical professional or facility.Which Medicare plan should you go with? Start with a list of factors to consider, make certain you're asking the appropriate inquiries as well as start focusing on what type of plan will best offer you and also your needs.

Medicare Benefit strategies are private insurance coverage policies that aid with the spaces in Medicare protection. They sound comparable to Medigap plans, do not puzzle the two, as they have some remarkable distinctions.

Report this wiki page